AusGroup posts profit for nine months of AU$2.3m.

AusGroup Limited (‘AusGroup’ or the ‘Group’) today announced its results for the three months ended 31

March 2019 (‘Q3 2019’), with profit in the quarter of AU$0.5m contributing to a nine-month profit of AU$2.3m

and revenue up 14% since Q2 2019 to AU$66.3m.

Q3 2019 highlights

- Profit result for the nine months to 31 March 2019 of AU$2.3m.

- EBIT of AU$1.9m and gross margins of 14.1% in Q3 2019.

- Balance sheet strength maintained with net worth at AU$96.3m.

- Debt service costs at lowest levels for five years following debt re-structure.

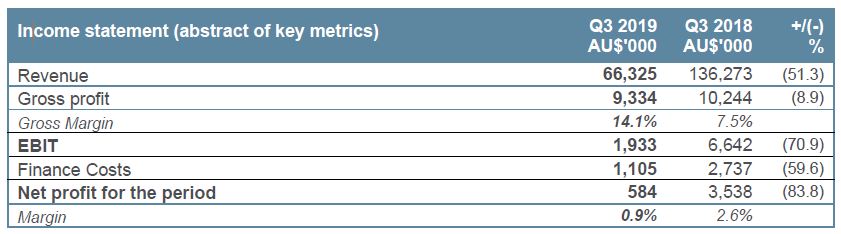

AusGroup has reported net profit after tax of AU$0.6m, which is lower than the comparative quarter mainly due to the completion of major projects in FY2018.

Revenue for Q3 2019 decreased by 51.3% quarter on quarter (QoQ) to AU$66.3m (Q3 2018: AU$136.3m) as a result of the completion of major project work in the previous period and timing delays in the start of new work. It is pleasing that the revenue for Q3 is on an increasing trend compared to the Q2 revenue of AU$58.3m.

Gross profit decreased by 8.9% QoQ to AU$9.3m in Q3 2019 (Q3 2018: AU$10.2m) again due to the drop in activity following the completion of the major projects in the comparative period. Whilst revenue is lower by 51.3% the gross profit is only lower by 8.9% (at a gross margin of 14.1% in the quarter) as a result of the successful settlement of completed projects.

EBIT of AU$1.9m for the quarter is less than the prior year’s comparative quarter, a decrease QoQ of 70.9% for the reasons outlined above.

Finance costs are now reducing to the lowest levels seen in the business for five years following the completion of the debt re-financing mentioned previously, the level of finance costs have reduced by 59.6% when compared to the previous period.

Financial position

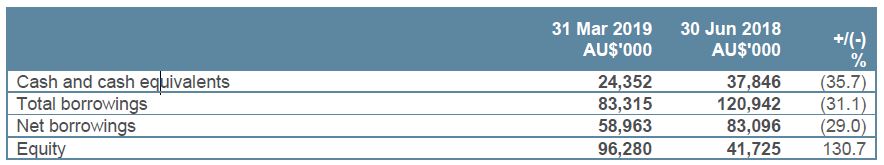

Cash and cash equivalents: Cash and bank balances decreased 35.7% by AU$13.4m to AU$24.4m at 31 March 2019 (30 June 2018: AU$37.8m), due to delayed settlements of claims which were subsequently received early in Q4 2019. These receipts of $8.9m returned the cash and cash equivalents to a consistent level of cash in hand since the start of the financial year.

Net borrowings have reduced by AU$24.1m since 30 June 2018 to AU$58.9m a drop of 29.0%, reflecting the partial repayment of the principal on the Noteholder debts and reduction in the long-term bank debt in the last two quarters.

Total shareholders’ equity as of 31 March 2019 has improved by 130.7% to AU$96.3m, an increase of AU$54.6m, which results from the increase in share capital following the completion of the fundraising activities under the share placement and rights issue.

Summary

Chief Executive Officer and Executive Director Shane Kimpton said, “Maintaining the trend of another profitable quarter is rewarding and demonstrates the underlying strength in the earnings base from our current portfolio. The business has stabilised during the quarter returning to more normalised levels of work following the very busy debt restructuring activities of the last six months. The recapitalisation of our business helps us maintain strong net worth and liquidity levels required to support the growth of the business across all operating sectors.”

This release should be read in conjunction with our SGX Announcement.